[ad_1]

Global ocean carriers reached the highest of the bullish market in 2022 by realizing excessive earnings largely on account of tight capability and exceptionally excessive container charges. In reality, analysts at Blue Alpha Capital mission that the world’s largest container strains are on the right track to put up earnings in 2022 that can prime 2021’s report by 73%.

Nevertheless, worldwide recessionary and inflationary pressures are actually chipping away at these fortunes. “Recession now seems possible in Europe and North America—economies that account for half of world output,” says Rahul Kapoor, vp at S&P Global Market Intelligence.

So, what components will most have an effect on ocean transport because it enters these stormy seas? Spencer Shute, principal marketing consultant at Proxima, identifies three tendencies: general discount in client demand; new ships including extra capability; and souring origin adjustments (off-shore vs near-shore or re-shore).

“All three components are resulting in decreased ocean charges, that are possible close to backside typically, and an elevated must companion with prospects [shippers filling containers] to make sure tools is appropriately positioned across the globe,” says Shute.

Container charges

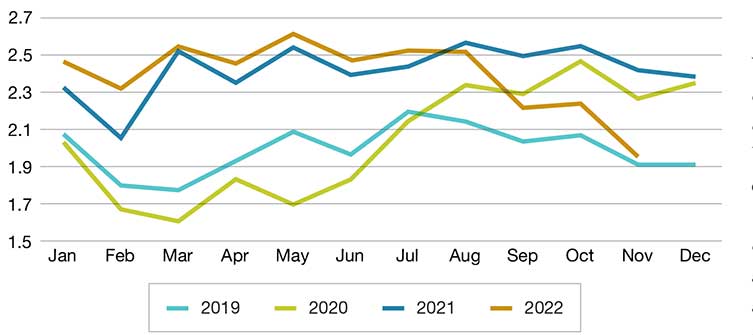

In response to Freightos knowledge, freight charges fell 21% to $2,607/forty-foot equal unit (FEU) in November, its lowest degree since December 2020 on account of slowing demand and decreased port congestion ranges. Freightos notes, nevertheless, that whereas this price is 72% decrease than a yr earlier, it’s nonetheless double its 2019 degree.

Whereas the persevering with Russia battle on Ukraine, skyrocketing gasoline costs, and a dramatic slowdown in client spending are contributing components, maybe the largest impression comes from China’s current surge in COVID circumstances and its strict “zero-COVID” technique.

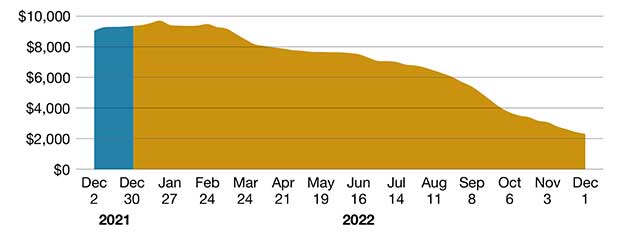

By the latter half of 2022, ocean charges started to plummet and continued to crash. HSBC World Analysis reported that the price of sending a container from Asia to the US collapsed by practically 90% in 2022.

“Instantly, we noticed a really heavy lower in cargo demand,” says Stefan Verberckmoes, an analyst at Alphaliner. “In the present day, Chinese language export freight charges are virtually on the similar degree as pre-pandemic.”

Joe Monaghan, CEO and founding father of Worldwide Logistics Group, expects trans-Pacific eastbound ocean charges to be totally restored to pre-pandemic ranges inside the second quarter of 2023. “They, finally, may attain 10-year lows by summer time,” he provides.

To guard price ranges in 2023, Monaghan notes that carriers will must be cautious with the capability they put into commerce lanes. “We might proceed to see clean crusing schedules quite sturdy once more,” he says. “With new vessels getting into the market this yr, this consists of persevering with to observe capability in particular trades to accommodate for the potential downfall in demand in 2023 and the additional softening of charges going into the 2023-2024 contract season.”

Document variety of ships on order

A possible purple flag for container capability is the big variety of ships container strains have on order. For 2023, a report 2.5 million TEU of recent containership deliveries is scheduled.

“On December 1, the order e-book was for about 7.5 million TEU, or 29% of the present fleet. That’s large,” says Stefan Verberckmoes, an analyst at Alphaliner. “We don’t have a worldwide financial system that’s rising 20% to 30%.”

Drewry Provide China Advisors reviews how, in late 2021, 1 million TEU of recent capability was scheduled to be delivered in 2022. “The capability growth may very well be as much as 250% of what occurred in 2022,” says Philip Damas, managing director at Drewry.

Nevertheless, container strains are at present not searching for so as to add capability. Verberckmoes attributes many new orders to carriers’ makes an attempt to fulfill environmental rules akin to IMO 2023. “Numerous these ships are LNG, and a few are already on methanol,” he says.

Plus, in January 2023, the Worldwide Maritime Group launched one other set of rules supposed to cut back emissions of GHG from transport: the Power Effectivity Current Ship Index and the Carbon Depth Indicator.

To keep away from a whole market meltdown, analysts predict that carriers will attempt to defer a few of this enormous extra capability to 2024 and cut back capability by cancelling sailings or by idling ships.

Container strains are additionally altering the forms of vessels that they’re ordering. Quite than investing in massive 24,000 TEU ships, orders are being positioned for 13,000 TEU to 16,000 TEU neo-Panamax vessels and compact vessels of round 5,000 TEU to 10,000 TEUs.

Compact ships are huge and quick, which means they occupy much less berth house at terminals. Neo-Panamax ships are very versatile and will be deployed on virtually any route. Verberckmoes surmises that neo-Panamax ships will grow to be the brand new workhorse.

Analysts predict vital market volatility disrupting container transport trade this yr. Philip Damas, managing director at Drewry Supply China Advisors, says that the consultancy expects ocean carriers to normalize operations and cease chasing spot markets. “They are going to notice intense worth competitors,” he says.

The pattern of spot ocean freight charges already exhibits that such charges have fallen practically as quick as they rose when the transport growth began in mid-2020. Based mostly on the Drewry World Container Index, common spot charges throughout eight main transport routes have dropped by 75% on common by way of December 2022.

“12 months-long, 2023 contract ocean charges will observe the sharp fall in spot charges,” Drewry predicts. “Decrease supply-demand, decrease gasoline prices and decrease capability self-discipline amongst ocean carriers are all pointing to a lot decrease ocean charges in 2023.”

Drewry specialists calculate that spot ocean charges will proceed to dive till the primary quarter of 2023, at which era they’ll attain the break-even price of carriers. “When this occurs, ocean carriers must resolve whether or not they have interaction in a worth battle—and undergo losses—or whether or not they pull capability again and stabilize ocean charges,” Damas says.

In both state of affairs, Drewry expects contract charges to a minimum of halve in 2023 on most routes. “The $10,000 ocean charges of 2021 to 2022 will quickly be previous historical past,” Damas provides.

Much less port congestion

Additionally affecting capability is the easing of seaport congestion. Final yr, a lot capability was tied up ready to berth. In the US, seaports on each the West Coast and East Coast confronted the worst congestion ever because the age of containerization.

In the present day, Verberckmoes notes that just about all the about 10 % of the worldwide fleet that was blocked by port congestion is now crusing once more.

In response to Drewry’s port congestion report tracker, high-volume ports in North America have decreased the incidence of port congestion by about 75% since December 2021, however they haven’t but introduced congestion again to pre-pandemic ranges.

“Much less port congestion means each extra dependable transportation operations, decrease prices from delays and extra productiveness from ships—and due to this fact simpler transport capability,” says Damas.

World container index ($ per 40 foot container)

Supply: Drewry

Higher alignment of operations

One silver lining for shippers is that ocean container charges are lastly coming down—and drastically. “We count on all the pandemic beneficial properties [to container lines] to be given away and ocean transport to grow to be a shipper’s market once more,” says Kapoor.

Now with ample capability on each the vessel and container facet of the enterprise, Christian Roeloffs, co-founder and CEO of Container xChange, sees the excessive risk of an all-out worth battle in 2023. “With the aggressive dynamics within the container transport and liner trade, I particularly don’t count on the massive gamers to carry again, and we do count on costs to come back all the way down to virtually variable prices,” he says.

Drewry predicts carriers will attempt to restore the various broken enterprise relationships with producers and retailers who suffered poor transportation service at excessive costs for practically two years. Analysts there count on that with a decrease supply-demand stability in transport, producers and retailers will regain bargaining energy in 2023 and negotiate the return of extra favorable contract phrases that many loved earlier than the pandemic.

“Areas to concentrate on are capability ensures, ‘useless freight’ in addition to demurrage penalties and cost phrases,” says Damas. Drewry additionally sees a greater alignment of ocean transport operations and inland move planning at origin in Asia—now known as “origin administration.” “This could as soon as once more grow to be potential, now that ocean transport is turning into extra dependable,” he says.

U.S. container import quantity (TEUs, hundreds of thousands)

Supply: Datamyne

Monaghan provides: “We totally count on [our customers] to ask for fastened charges once more to get stability, even when it means the speed is increased than the present spot market. They don’t wish to return to paying $20,000 for a container. The precedence is on the power to plan.”

With a big oversupply of containers and an additional inflow of extra TEUs in 2023, Container xChange expects transport strains to proceed to cut back vessel capability and droop providers by introducing appreciable clean sailings. Maersk, for one, has already indicated that it’ll proceed “to make capability changes on providers from Asia to North America, Europe and the Mediterranean to raised align with demand fluctuations.”

“With a view to tackle demand discount, ocean carriers generally return to clean sails to cut back capability accessible on ships,” says Shute. “Along with clean sailings, ocean carriers have checked out lowering supply velocity by utilizing slower sailings.”

Roeloffs even foresees market consolidation initially beginning with carriers defaulting and lowering their fleet. “Just lately, there was information about China United Strains, an rising provider on trans-Pacific and Asia-Europe providers, being vulnerable to defaulting on a charterparty involving greater than 10 containerships,” he says.

Monaghan predicts that it will not be stunning to see a minimum of one of many prime 10 international ocean carriers disappear, possible by way of merger or acquisition.

The chartering enterprise is especially feeling the impression of those financial occasions. Verberckmoes factors out that the majority non-vessel proudly owning constitution providers that got here into the enterprise through the growth—the so-called newcomers—are actually out of enterprise. Additional, Costco reserved $93 million within the third quarter of 2022 to pay as a compensation for the early termination of seven chartered ships, which have been fastened on the peak of pandemic congestion.

“The lower in charges and cargo volumes got here a lot sooner than we anticipated,” says Verberckmoes. “And for those who look to the longer term, gasoline capability is basically worrying. Carriers might want to use all their accessible instruments to be disciplined.” This consists of managing capability with clean sailings and closed loops.

Key takeaways

What can shippers study from the ocean provider trade this yr? For one, they’ll lastly plan their provide chains primarily based on regular and fewer disrupted ocean transportation operations.

“They need to demand from ocean carriers a return to clear service ranges and a greater monitoring of efficiency and delays,” advises Damas. “This yr needs to be a purchaser’s market and current alternatives to deliver ocean contract costs near pre-pandemic costs. Shippers ought to spend time getting perception into goal charges for 2023 contracts to maximise financial savings.”

In reality, this yr, shippers and freight forwarders will have the ability to go window buying. “There’s going to be a variety of room for negotiation, particularly within the early components of the yr,” says Roeloffs. “Contract charges will observe go well with as spot charges fall considerably.”

Nevertheless, international re-alignment because of provide chain constraints would be the largest unknown for ocean carriers. “Many firms, significantly small- and medium-sized enterprises, are evaluating their present provide chain methods and evaluating which fashions cut back danger as an entire,” provides Shute.

Whereas specialists anticipate extra efforts towards diversification of provide chain sourcing and manufacturing away from dwelling, many see this as a long-term view that requires imaginative and prescient and technique from firms on the lookout for a extra resilient provide chain. In the meantime, Roeloffs expects extra elevated container volumes intra-Asia and extra nations will emerge as potential alternate options like Vietnam and India.

Subscribe to our electronic mail e-newsletter and we’ll maintain you recent.

![]()

[ad_2]