[ad_1]

Features such as network slicing and ultra-low latency are necessary for critical IoT applications. Realizing 5G New Radio’s potential requires investment in Standalone 5G networks.

The most significant part of the 5G revenue opportunity is likely to come from enterprise use cases. Over 80% of telco CEOs predicted this at the dawn of the 5G era, which remains true today. But, many of these enterprise use cases and applications need Standalone 5G networks. So why have only 10% of operators with a 5G network – a little over 20 – deployed it?

Last week, Apple introduced the iPhone 14 lineup. One thing they did not talk about during the presentation of the new models was their 5G capability. Today, everyone takes it for granted.

For most consumers, 5G is a no-brainer. Your new smartphone shows the 5G symbol on the screen, and you know it is connected to a 5G network. But what is the difference in user experience from the previous 4G networks? Not much! Unless you are a heavy smartphone video game player and connect to a 5G mmWave antenna, you won’t notice any significant difference in bandwidth and performance.

There are some barely noticeable differences, though. For starters, it helps with power consumption on both the network and the connected devices: 5G is more power efficient per bit. Also, it allows for connecting more devices per channel, easing the bottlenecks that appear in heavily populated areas.

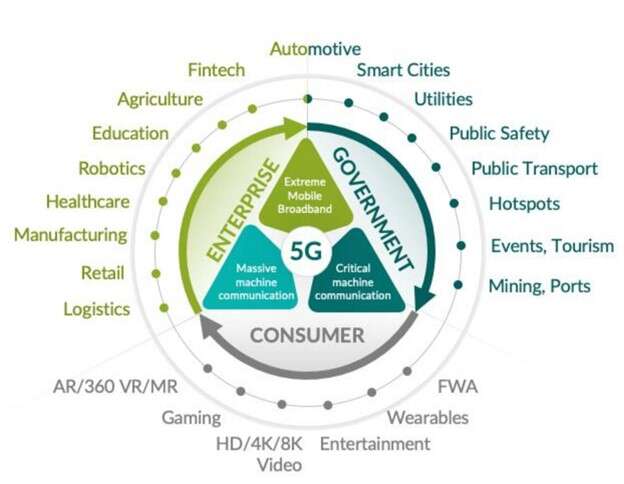

But the real benefits of 5G, with features such as ultra-reliable low-latency communications (URLLC) and network slicing, are for critical applications such as robotics, connected vehicles, fixed wireless access, remote operations, and others requiring the stability and reliability of the wireless network.

Unfortunately, despite the rush to launch 5G networks in many mature markets, most of the existing ones cannot provide some of those advanced features, as they are Non-Standalone, requiring an existing 4G LTE network to operate.

Many CSPs are waiting for 5G Advanced to optimize investments

According to GSMA Intelligence, in 2019, when operators launched the first 5G networks, most were planning to roll out Standalone 5G in large numbers within 2-3 years. Today, however, only 13% of the current 5G networks are Standalone.

As argued above, most consumers only notice some minor changes in their connectivity experience when using a 5G network. They don’t ask for more as long as it says 5G and the connection is stable.

As inflation is at a 40year high in most industrialized countries, the competition to gain new customers is growing, as well as the pressure to contain pricing for cellular and internet services. Meanwhile, the cost of upgrading and maintaining infrastructure is rising due to inflation and supply chain challenges.

Therefore, many CSPs are holding on to upgrading to Standalone 5G because they don’t see any significant monetization opportunity in their markets to justify the investment. Some of them are waiting for the 3GPP Release 18, also known as 5G+ or 5G Advanced, to make the upgrades.

5G-Advanced will enable all the features of 5G Standalone and additional network capabilities such as New Radio Reduced Capability (NR-REDCAP), enabling massive IoT on low-power battery-operated devices.

CSPs know what Standalone 5G can do, but they find it hard to sell it

One of the biggest challenges for many operators is the lack of digital transformation experts in their sales teams. Most carriers are large organizations used to sell connectivity solutions, such as fixed lines, fiber, and cellular voice and data.

CSPs are also facing increasing competition from suppliers of private wireless networks. While some large operators have teamed up with infrastructure providers to enter this lucrative market, many are still trying to figure out how to address the potential customers’ needs.

CSPs need to improve their digital transformation portfolio and competence to realize the potential of 5G and some features of 5G Standalone.

Asia and Europe are leading the way to 5G Standalone

The industry expects Standalone 5G deployments to accelerate this year and beyond. According to GSMA Intelligence, the Asia Pacific region has 12 Standalone 5G networks of the 46 in operation. Europe, however, is catching up quickly, and its carriers plan to have 48 Standalone networks in the next two years. The Asia Pacific region will add another 25, and North America, with four existing ones, will add another five.

The main reason for Europe moving faster is industrial IoT. As many organizations accelerate their digital transformation, wireless reliability and lower power consumption are crucial for success.

In other markets, where 5G is just arriving, and it is mostly used for consumer applications and fixed-wireless access, operators will likely consider additional investments when Release 18 is ready and they can see a solid ROI on improving their infrastructure.

[ad_2]